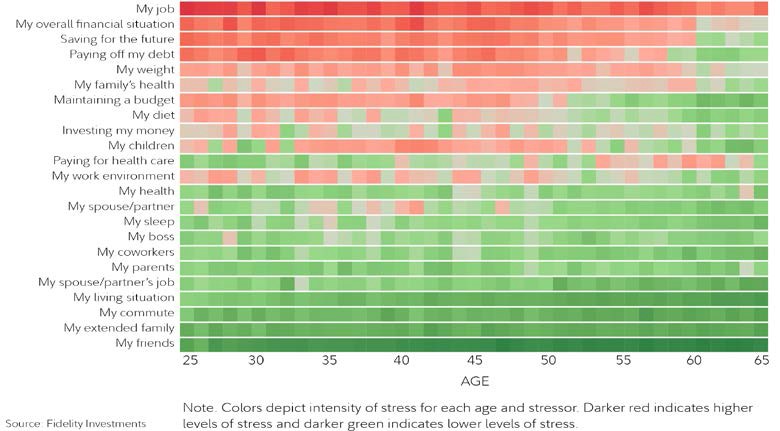

The two top stressors in American life are jobs and finances. “My weight” and my family’s health follow just behind these across the generations.

Total Well-Being, a research report from Fidelity Investments, looks at the inter-connections between health and wealth – the combined impact of physical, mental, and fiscal factors on our lives.

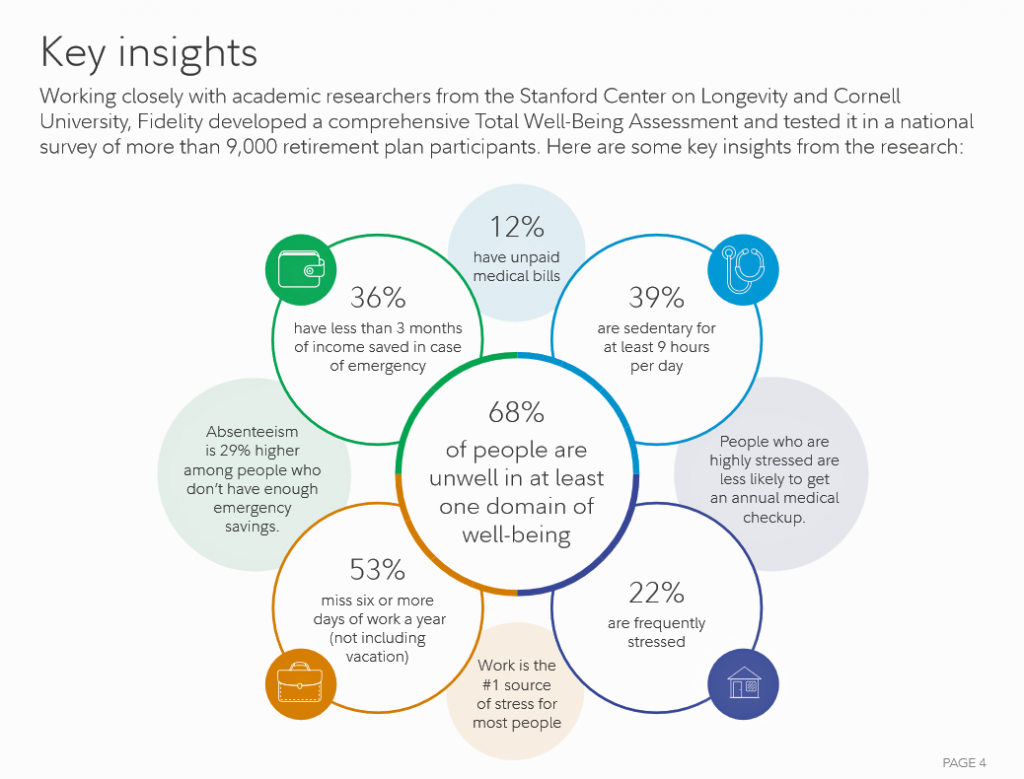

The first chart summarizes the study’s findings, including the facts that:

- One-third of people have less than three months of income in the bank for emergency

- Absenteeism is 29% greater for people who don’t have sufficient emergency funds saved

- People who are highly stressed tend not to get an annual medical checkup, and,

- Over half of working people miss six or more days of work a year.

Fidelity calculates a total well-being score based on four domains of wellness:

- Financial, which covers budgeting, debt, insurance and savings (or lack thereof)

- Health, covering behaviors, mental and physical facets

- Work, addressing burnout, career status, and work/life balance, and

- Life, comprising relationships, personal satisfaction, and purpose.

The health-wealth connection is very clear, Fidelity’s data demonstrates; only 14% of people struggling with debt are likely to be excellent health, get less sleep, and are nearly twice as likely to feel stressed or anxious. Simply put: poor financial health contributes to poor physical health, and “vice versa,” Fidelity says. Just 4% of workers in poor health generated high financial wellness index scores.

Fidelity surveyed 9,315 workers with 401(k) or 403(b) accounts in the firm. Ages of respondents ranged from 21 to 75 (median 45), equally distributed across generations Millennial, Gen X, and Baby Boomers, and gender. Two-thirds had a college degree or more.

Health Populi’s Hot Points: This “heat map” arrays workers’ perceptions of persona life stressors, from the reddest “burning” issues of jobs and finances down to the green, healthier life buffers of a good commute, extended family and friends.

Health Populi’s Hot Points: This “heat map” arrays workers’ perceptions of persona life stressors, from the reddest “burning” issues of jobs and finances down to the green, healthier life buffers of a good commute, extended family and friends.

Note some of the “pink” areas that begin to put at-risk wellness: work environment, paying for health care, my kids, investments, my diet, budgeting, and my family’s health.

See that weight ranks quite high on this list, after finance and debt.

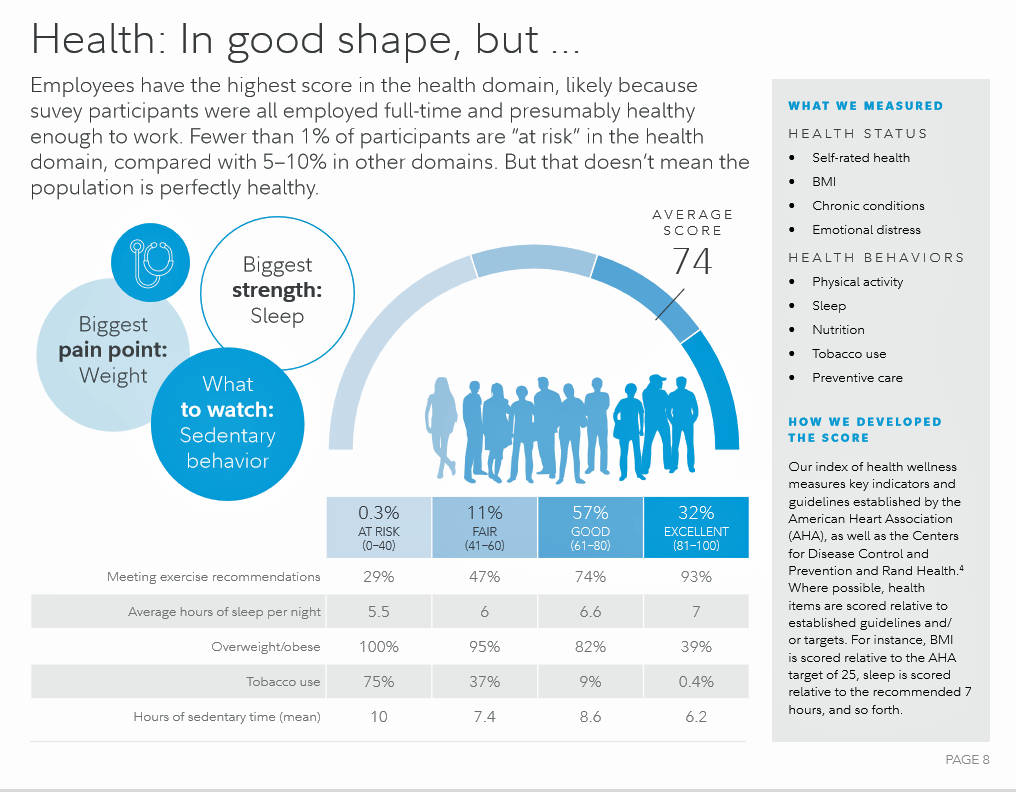

The third chart pulls out the health factor embedded in Fidelity’s index, with the finding that health may look “in good shape” on the top-line, but underneath the biggest pain point is weight. Even among the 57% of workers polled who were in “good” health, 82% were overweight or obese. And 39% of those in “excellent” health were found to be overweight or obese.

In the U.S., weight is playing a growing negative influence on un-wellness and on greater risk for worker productivity and the national economy at-large. See my recent post on weight’s impact on U.S. healthcare spending and the macroeconomy here in Health Populi.

This challenge presents a big opportunity for the legacy healthcare system to collaborate with the retail health ecosystem — pharmacies and grocers, farmers and food pantries — for the health-benefit of consumers.

The post Wealth is Health and Health, Wealth, Fidelity Knows – with Weight a Major Risk Factor appeared first on HealthPopuli.com.

Wealth is Health and Health, Wealth, Fidelity Knows – with Weight a Major Risk Factor posted first on http://dentistfortworth.blogspot.com

No comments:

Post a Comment