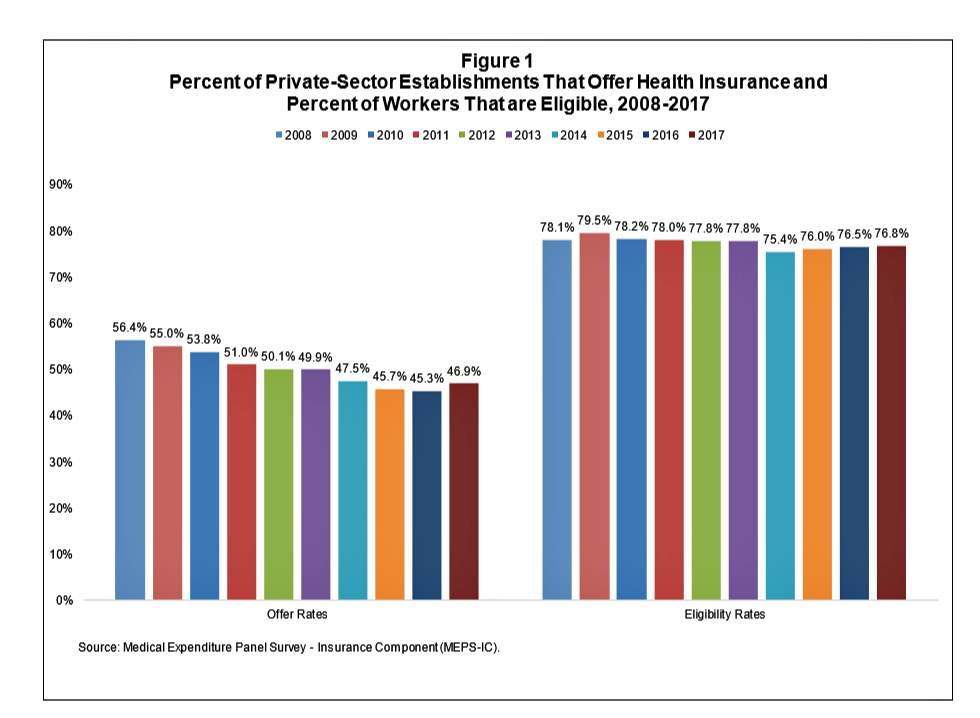

After eight years of decline, more U.S. employers offered health insurance to workers in 2017, EBRI reports in its latest Issue Brief.

In 2017, 46.9% of U.S. companies offered health insurance to their employees, up by 1.6 percentage points from a low of 45.3% in 2016.

For perspective, ten years earlier in 2008, 56.4% of employers offered health insurance, shown in the first bar chart (Figure 1 from the EBRI report).

The largest percentage point increase in health plan offer-rates came from the smallest companies, those with less than 10 employees: while 21.7% of those companies offered health insurance in 2016, 23.5% did so in 2017. This calculates to an increase of 8.3% of employers offering insurance to workers.

Offer rates among other size firms stayed relatively flat or slightly declined between 2016 and 2017.

Looking back to 2015, health insurance offer rates increased across all firm sizes except for the largest firms with 1,000 or more employees, which stayed relatively flat over the two years at 99.4% and 99.3%.

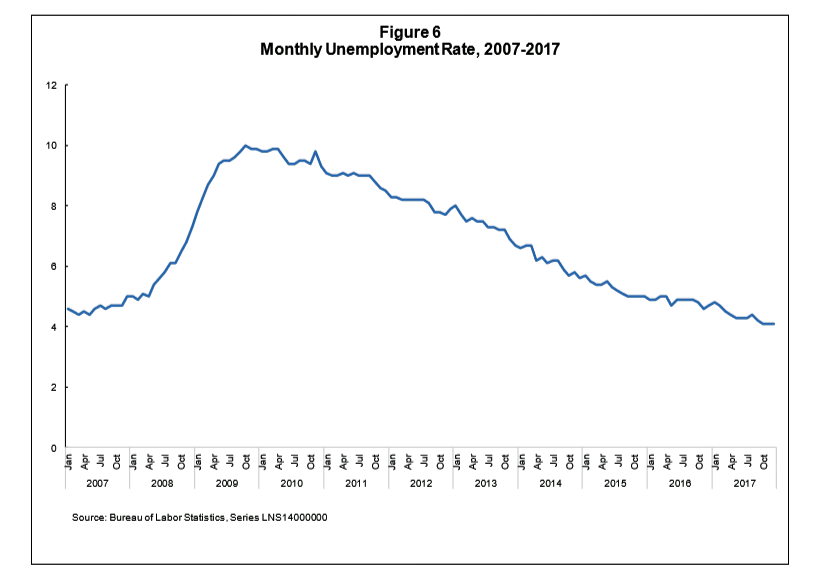

Unemployment in the U.S. has declined, year over year, since the height of the Great Recession in 2009. By 2017, the second chart (Figure 6 from the report) shows unemployment at a low point of 4.1% by the end of 2017. “When unemployment is low,” Paul Fronstin of EBRI writes, “recruiting and retaining workers becomes a bigger challenge for employers, including some smaller employers, which in turn often means improving compensation and benefits.”

Employers have generally shifted more healthcare financial risk onto employees in the form of greater emphasis on consumer-directed health plans: high-deductible insurance coupled with health savings accounts, along with more attention to wellness and population health management programs — “supporting greater consumer engagement in health care,” the report notes.

In the conclusion of the report, EBRI calls out the wild card in this story: will U.S. employers continue to offer health insurance in the future? The answer to that question lies in public policy, specifically whether tax treatment will change for companies offering health insurance (e.g., ERISA), so-called “Cadillac Plan” treatment taxing high-cost health insurance, and whether health care costs can continue to be borne, in part, by employers in light of global business competition from countries that cover health insurance as a public good.

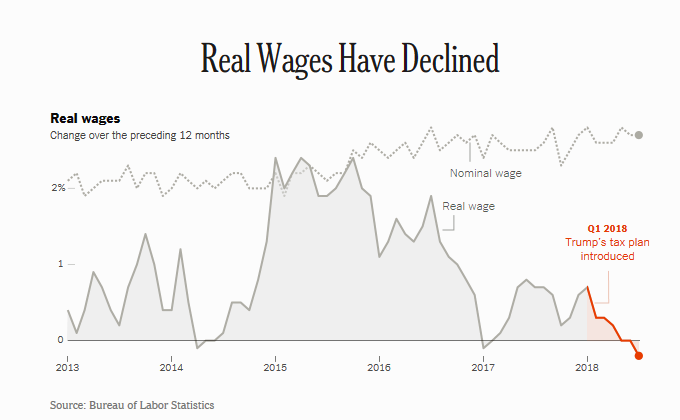

Health Populi’s Hot Points: Workers’ real wages have declined in the past year, owing to higher oil prices (translating at the gas tank) which off-set any modest increases in income Americans might have seen in their paychecks from the 2018 tax cut bill.

Health Populi’s Hot Points: Workers’ real wages have declined in the past year, owing to higher oil prices (translating at the gas tank) which off-set any modest increases in income Americans might have seen in their paychecks from the 2018 tax cut bill.

Wages grew 2.7% in the 12 months August 2017-July 2018. The tax cut was expected to save $930 for families earning between $48,600 and $86,100 this year, a Brookings-Urban Institute analysis calculated.

Gas price hikes have eaten into any gains average consumers may have enjoyed from the tax cut, amounting to about $30 a month in marginally more fuel costs. As an analyst writing for The Street observed, “In the Trump economy, it’s one step forward, one step back.”

In the meantime, one-half of healthcare executives told Venrock in a recent survey that the most important healthcare event of the past year wasn’t the Amazon-Berkshire Hathaway-JP Morgan partnership or the CVS/Aetna merger deal — it was the survival of the Affordable Care Act.

Both business leaders and consumers alike know that the U.S. healthcare economy is integrated into the nation’s overall macro-economy — and Americans’ kitchen table economics.

For some historical perspective, the topic of Gas ‘n Health Care was the topic of my inaugural Health Populi post exactly eleven years ago Labor Day week 2017.

The post More U.S. Companies Offering Health Insurance After 8 Years of Decline appeared first on HealthPopuli.com.

More U.S. Companies Offering Health Insurance After 8 Years of Decline posted first on http://dentistfortworth.blogspot.com

No comments:

Post a Comment