CVS Health’s acquisition of Aetna was approved this week by U.S. Federal regulators after months of scrutinizing the antitrust-size-market control implications of the deal.

I wrote this post on the deal as an inflection point in American healthcare on 3rd December 2017 when CVS and Aetna announced their marriage intentions. This post updates my initial thoughts on the deal, given the morphing US healthcare market on both the traditional health services front and fast-evolving retail health environment.

The nation’s largest retail pharmacy chain signed a deal to combine with one of the top three health insurance companies. The deal is valued at $69 billion.

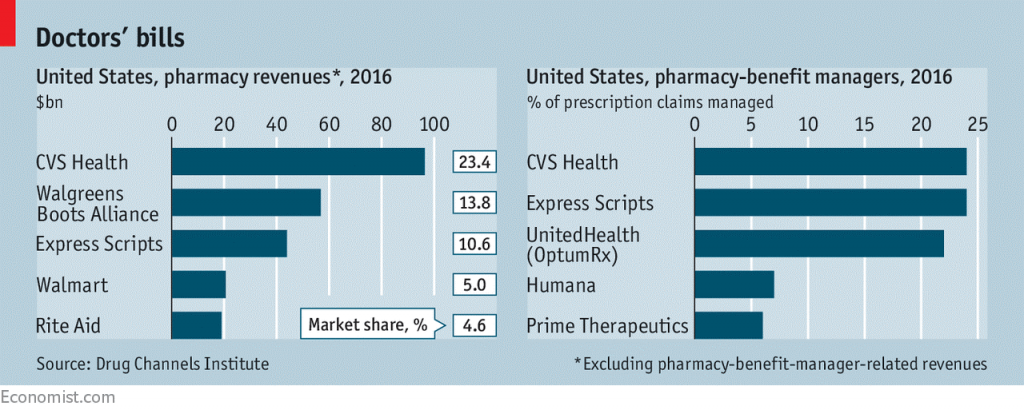

CVS is both the biggest pharmacy and pharmacy benefit manager in the U.S., as the first chart shows. Previously in Health Populi, I’ve talked about the value of vertical integration for CVS to bring together the building blocks of retail pharmacy and pharmacist care, retail clinics, the PBM (Caremark), along with Aetna’s health plan member base and business.

As Amazon and other entrants apply their innovative approaches and technologies into American healthcare, consumers are expecting more streamlining, convenience, and lower (and transparent) prices. The legacy healthcare system — hospitals, insurance companies, and pharma — haven’t delivered on that expectation.

This year’s Temkin Experience Index ranked health insurance among the lowest consumer-facing experiences, and Interbrands’ released their 2018 Best Global Brands report this week — which names only a couple of health-focused companies.

The top 4 tier of these beloved brands cover technology – Apple, Google, Amazon, and Microsoft – with Amazon growing an astonishing 56% over last year in terms of customer obsession, invention, operational excellence, and long-term thinking.

Oh, what those values could do for consumer-focused healthcare!

In the context of CVS + Aetna, we look to the promise of vertical integration of health services that could benefit the consumer’s health outcomes via inventive approaches to continuity of care and ongoing support between doctor’s appointments (say, by leveraging Minute Clinics for population health programs); streamlining processes to lower costs in community-based, lower-cost settings; and, keeping strategic consumer-centric eyes on the long-term based on Interbrands’ metric.

Since the CVS+Aetna announcement last December, the Kaiser Family Foundation ran some numbers on how the merged organization could impact Medicare — a key payor for both health insurance and prescription drugs under Part D. KFF found that the organization would cover 3 in 10 Medicare Part D enrollees, and grow CVS’s role in Medicare Advantage, too.

Health Populi’s Hot Points: Just before CVS announced its plans to bring Aetna into its corporate fold, CVS published the results of a consumer survey, conducted in October 2017, about the state of U.S. healthcare. Most Americans said that thinking about the nation’s healthcare system made them feel sad, pessimistic, and angry — not proud or optimistic. By far, the most serious issues facing American healthcare consumers were the lack of (1) affordable care, (2) affordable insurance, and (3) affordable drugs, shown in the bar chart.

When I first penned the CVS + Aetna merger post in December 2017, we had received several signs from inside-the-DC-Beltway that the prescription drug industry would be under pressure to lower the price of medicines. One of three key moments was heard during the hearing of Alex Azar II, President Trump’s appointee to lead the Department of Health and Human Services testified to the Congressional committee that he would be keen to enact tactics that lower drug prices, such as allowing Medicare to negotiate directly with drug companies. Note that Azar was once President of Eli Lilly, among the world’s largest pharma companies and marketer of products that treat diabetes, among other conditions. During the hearing, Senator Patty Murray (D-WA) challenged Azar, “As a pharmaceutical executive, you raised drug prices year after year. Eli Lilly is currently under investigation for working, under your tenure, with other drug companies to needlessly raise the price of insulin.”

Second, the National Academy of Science published a well-researched report supporting government prescription drug price negotiation. The Academy convened a team with experience and gravitas to inform this report. In parallel with the publication of this report were also dissenting opinions from two participants who came out of the pharma industry: Michael Orsenblatt, formerly President and Chief Medical Officer at Merck, and Henri Termeer, former CEO of Genzyme. “Allowing all government health plans to negotiate as a single block would establish a near monopoly,” the document asserted.

Third, pharmacists in the state of Michigan launched a campaign to educate Michiganders about the high price of medicines in the state and potential solutions to the challenge.

CVS/pharmacy rebranded itself as CVS/health about four years ago when the company quit the tobacco-selling business and doubled-down on health-focused investments. The Economist (whose art is shown in the third image), asked on November 4, 2017 whether this merged organization could deliver “the right dose” for U.S. healthcare. Clearly, CVS continues to need to grow beyond the core retail pharmacy business and come out in front of the counter as part of its growing health/care focus as the company’s sale of prescription drugs has recently slowed and prospects for pricing and disruption via Amazon and other tech-enabled developers who want to reinvent drug distribution channels loom close.

Aetna’s business, too, has needed to scale in new ways, as the health insurance business seeks certainty, business models, and scale economies.

There’s another bit of news out this week re-shaping the retail health landscape: that Walgreens is now partnering with LabCorp to be a channel for consumer-facing clinical lab testing. Now that Walgreens is out from under its ill-fated relationship with Theranos, the pharmacy chain has moved beyond that sad affair and onto a partnership with a ubiquitous, consumer-trusted lab player.

Considering the CVS + Aetna combination through health consumers’ eyes, vertical integration can be a good thing for patients and caregivers if the company can streamline and artfully design delightful experiences while serving up value-based care in terms of both cost-value and patients’ own values with greater skin-in-the-healthcare-payment-game.

The post CVS + Aetna: Inflection Point in US Healthcare, Merger Approved Update appeared first on HealthPopuli.com.

CVS + Aetna: Inflection Point in US Healthcare, Merger Approved Update posted first on http://dentistfortworth.blogspot.com

No comments:

Post a Comment