Medicare provides health insurance for 58.4 million Americans. To provide health care to largely elderly Americans, it spent $710 billion in 2017. One key question is, does the federal government have the funds to continue to support this program as the baby boomers retire?

According to the 2018 Medicare Trustees report, the answer is increasingly pessimistic. The Medicare Trust Fund will run out of money by 2026, three years earlier than previously anticipated.

Kaiser Health News interviewed a senior government official who said that:

…the trustees projected lower wages for several years, which will mean lower payroll taxes, which help fund the program. The recent tax cut passed by Congress would also result in fewer Social Security taxes paid into the hospital trust fund, as some higher-income seniors pay taxes on their Social Security benefits. The aging population is also putting pressure on the program’s finances.

Some other interesting points:

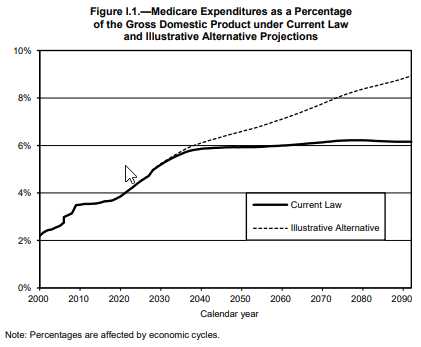

- Medicare will make up 6.2-8.9% of the U.S. economy by 2092. This depends on whether you use the current law projection or the more realistic “illustrative alternative”. The illustrative alternative: (i) reduces provider payments by healthcare-specific rather than overall productivity, (ii) moves from current law to the Medicare economic index (MEI) to adjust physician payments, (iii) assumes physician bonuses will continue indefinitely after 2025,

- MA continues to gain market share. One interesting point made in the report is that 34% of Medicare beneficiaries are enrolled in Medicare Part C (aka Medicare Advantage), which is Medicare’s managed care alternative.

- Fuzzy physician reimbursement accounting continues. In previous years, the Trustees report had to deal with the sustainable growth rate (SGR) provision which gradually reduced physician reimbursement. Although SGR was law, each December, Congress would reverse SGR for the next year. Finally, the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) ended SGR. However, there is still some cost savings that will likely not materialize in the future. The report says: “In particular, additional payments of $500 million per year for one group of physicians and 5-percent annual bonuses for another group are scheduled to expire in 2025, resulting in a significant onetime payment reduction for most physicians. In addition, the law specifies the physician payment update amounts for all years in the future, and these amounts do not vary based on underlying economic conditions, nor are they expected to keep pace with the average rate of physician cost increases.” Under current law, access to Medicare physicians could prove difficult in the long-run.

- Payment rate reductions included in Trustees report, but unlikely to happen. The ACA mandated that provider reimbursement rates are reduced by the growth in economy-wide private nonfarm business multifactor productivity. Yet as Baumol’s Cost Disease suggests and the Medicare Trustees aree with, “In

order for this outcome to be achievable, health care providers would have to realize productivity improvements at a faster rate than experienced historically.”

Source:

- 2018 ANNUAL REPORT OF THE BOARDS OF TRUSTEES OF THE FEDERAL HOSPITAL INSURANCE AND

FEDERAL SUPPLEMENTARY MEDICAL INSURANCE TRUST FUNDS.

What we learned from the 2018 Medicare Trustees Report posted first on http://dentistfortworth.blogspot.com

No comments:

Post a Comment