When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019.

However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household.

Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves.

I’ve curated the four charts from the study to explain this story. Here is the first “good news” line chart, showing declining medical trend from 2007 to next year in 2019. The 6% trend is equal to that of 2018, illustrating a flat scenario, roughly the same trend seen in 2016 at 6.2%. That’s one-half the high point at nearly 12% in 2007. That’s good news indeed, from a healthcare cost bird’s-eye view.

The second graphic, labeled Figure 3, compares national health spending as a share of U.S. gross domestic product (GDP) versus what employers spend as a share of workers’ wages. See the growing line-item of employer health spending as a share of employee earnings grow decade by decade.

The second graphic, labeled Figure 3, compares national health spending as a share of U.S. gross domestic product (GDP) versus what employers spend as a share of workers’ wages. See the growing line-item of employer health spending as a share of employee earnings grow decade by decade.

The point here is that the share of employee earnings devoted to healthcare has grown: workers have traded off wage increases for healthcare benefits, a central theme over the ten+ years that I’ve written this blog. In 2007, the year I launched Health Populi, the inaugural post focused on just this issue; the post was titled, “Health care is the #1 line item in our national economy…and taking more out of your pocket.” That was written in the 2001-2010 period of healthcare spending, so an old story giving me feelings of déjà vu.

“Employer health spending has grown from 6 percent of total wages in 1988 to more than 12 percent in 2018,” driven by healthcare prices growing faster than the general economy, and the adoption of new technologies, procedures, and increasingly expensive new prescription drugs, PwC observes.

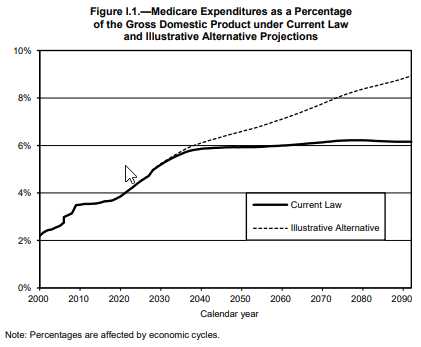

Even with moderating medical trend growth, the Centers for Medicare and Medicaid Services (CMS) expect that healthcare spending will account for 20% of the U.S. economy by 2026.

Even with moderating medical trend growth, the Centers for Medicare and Medicaid Services (CMS) expect that healthcare spending will account for 20% of the U.S. economy by 2026.

Now, to Figure 4 (the third graphic). This shows growth in consumer personal income adjusted for inflation. That’s the issue of flat wages mentioned in the previous paragraphs. PwC notes that consumer income had a “dramatic drop” in 2015 and 2016, which will lead to a dampening impact on healthcare spending in 2019. Wage growth in 2017-18 will then drive healthcare spending up again in 2020, which has been demonstrated by a two-to-three-year lag that CMS’s actuaries have observed over many years.

With employers’ goal of bending their cost curve (and in turn, that for workers), more employers are offering different “front doors” to services. These include health risk appraisals, biometric screenings, weight management, and health coaches: at least one-half of employers are offering these four services, PwC’s research found.

The fourth graphic (labeled Figure 8) illustrates the percent of consumers likely to access new care options outside of bricks-and-mortar doctors’ offices if these services were lower cost:

56% of people would use telehealth via smartphone for a dermatologist to examine a skin problem

56% of people would use telehealth via smartphone for a dermatologist to examine a skin problem- 49% of consumers would have a live visit with a physician via smartphone

- 45% would have stitches or surgical staples removed at a retail clinic.

Employers are also enlisting the services of third-party health advocate services to help patients, now consumers, navigate the complex and expensive health system. Advocacy services include price transparency, identifying appropriate clinical trials for participation, identifying mental/behavioral health providers in a local market or virtual telehealth program, or finding a specialist for a rare condition. These organizations collect data on consumers which can be used to better coordinate care, as well as, if married to practical artificial intelligence, predict health needs in advance of disease onset.

To stay relevant in this future scenario of more virtual and retail health channels, a plurality of health providers would consider aligning with various non-hospital healthcare providers such as skilled nursing facilities, outpatient centers, retail clinics, home health agencies, acute rehabilitation, and hospice agencies.

Health Populi’s Hot Points: Financial wellness is a benefit in companies building a culture of health and an integrated employee benefits strategy embedding wellness across all components of the compensation package. Smart companies realize that financial stress contributes to absenteeism and challenges with presenteeism, along with being a risk for various health conditions — both physical and emotional/behavioral.

The final chart shows the growth curve for U.S. consumers’ healthcare spending as a percent of their disposable income. The Bureau of Labor Statistics tells us that currently, consumers spend $1 in every $5 of household spending on healthcare — and that’s just the stuff included in healthcare claims.

In previous research, PwC has calculated consumer spending on other health-related services and products that people gladly pay for out-of-pocket, outside of the health insurance premium copayments, coinsurance, insurance premiums and deductibles.

It’s no surprise, then, that healthcare spending continues to be the top pocketbook issue among Americans.

As with public sector healthcare spending (“entitlements” in the form of Medicare and Medicaid), healthcare spending crowds out U.S. consumers’ ability to spend on other household line items, like college education, automobiles, hard goods, entertainment, and vacations.

Americans’ credit health has eroded over the past few years, with 15 consecutive quarters of increasing debt, according to the Federal Reserve Bank of New York. The NY Fed found that household debt increased to $13.21 trillion in the first quarter of 2018, the 15th consecutive quarter with an increase that ranks the level higher than the previous peak of $12.68 trillion from the third quarter of 2008 — as the Great Recession hit the U.S.

Current political polling shows that voters, across the political spectrum, continue to rank healthcare costs as high priorities for the 2018 mid-term elections. Watch this space, and this blog, for continued focus on financial wellness, healthcare costs, and consumer sentiment.

The post As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress appeared first on HealthPopuli.com.

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress posted first on

http://dentistfortworth.blogspot.com

Hospital and healthcare providers are getting real about improving patient and health consumer experience, the latest Kaufman Hall research finds.

Hospital and healthcare providers are getting real about improving patient and health consumer experience, the latest Kaufman Hall research finds.

Health Populi’s Hot Points: There’s a hard return-on-investment for garnering patients’ satisfaction and HCAHPS scores. First, in terms of experience, customer experience guru

Health Populi’s Hot Points: There’s a hard return-on-investment for garnering patients’ satisfaction and HCAHPS scores. First, in terms of experience, customer experience guru

Health Populi’s Hot Points: The good news conclusion of the Health Ambitions Study is that consumers, indeed, have ambitious goals for their personal health. The opportunity-gap that physicians can fill is to help people address their health goals based on their health values. In my client work and speech-giving, I often point these days to a JAMA article,

Health Populi’s Hot Points: The good news conclusion of the Health Ambitions Study is that consumers, indeed, have ambitious goals for their personal health. The opportunity-gap that physicians can fill is to help people address their health goals based on their health values. In my client work and speech-giving, I often point these days to a JAMA article,

You can meet the Cafe Ambassador, who is akin to the Genius Bar concierge that provides an on-ramp to financial services you might need or want: a new savings or checking account, a home or auto loan, or perhaps a credit card.

You can meet the Cafe Ambassador, who is akin to the Genius Bar concierge that provides an on-ramp to financial services you might need or want: a new savings or checking account, a home or auto loan, or perhaps a credit card. Traditional healthcare stakeholders have begun to recognize the importance of design for health, from the hospital waiting and inpatient rooms to the enchantment of health apps and tools and beautifully designed “hearables” to aid people with hearing deficits, and an easy to understand the explanation of benefits like that shown here from a recent

Traditional healthcare stakeholders have begun to recognize the importance of design for health, from the hospital waiting and inpatient rooms to the enchantment of health apps and tools and beautifully designed “hearables” to aid people with hearing deficits, and an easy to understand the explanation of benefits like that shown here from a recent

Taking a page out of Hippocrates, “let food by thy medicine and medicine be thy food,” consumers are increasingly shopping for groceries with an appetite for health, found in research published this week by the International Food Information Center cleverly titled,

Taking a page out of Hippocrates, “let food by thy medicine and medicine be thy food,” consumers are increasingly shopping for groceries with an appetite for health, found in research published this week by the International Food Information Center cleverly titled,

The second graphic, labeled Figure 3, compares national health spending as a share of U.S. gross domestic product (GDP) versus what employers spend as a share of workers’ wages. See the growing line-item of employer health spending as a share of employee earnings grow decade by decade.

The second graphic, labeled Figure 3, compares national health spending as a share of U.S. gross domestic product (GDP) versus what employers spend as a share of workers’ wages. See the growing line-item of employer health spending as a share of employee earnings grow decade by decade. Even with moderating medical trend growth, the Centers for Medicare and Medicaid Services (CMS) expect that healthcare spending will account for 20% of the U.S. economy by 2026.

Even with moderating medical trend growth, the Centers for Medicare and Medicaid Services (CMS) expect that healthcare spending will account for 20% of the U.S. economy by 2026. 56% of people would use telehealth via smartphone for a dermatologist to examine a skin problem

56% of people would use telehealth via smartphone for a dermatologist to examine a skin problem

Yesterday at 1 pm, we learned that the incidence of suicide is up in America in

Yesterday at 1 pm, we learned that the incidence of suicide is up in America in  What do we know we know?

What do we know we know? Health Populi’s Hot Points: Why now, in the U.S., do we see the rate of suicides growing? As CDC notes in the new report, there is no one cause for each person’s decision to take their own life. The list of underlying dark forces is long….and pervasive in America. Some of the evidence-known factors contributing to suicide are:

Health Populi’s Hot Points: Why now, in the U.S., do we see the rate of suicides growing? As CDC notes in the new report, there is no one cause for each person’s decision to take their own life. The list of underlying dark forces is long….and pervasive in America. Some of the evidence-known factors contributing to suicide are: Take note of the resources available to all of us to prevent this ultimate self-medication: 1-800-273-TALK (8255).

Take note of the resources available to all of us to prevent this ultimate self-medication: 1-800-273-TALK (8255).

Health Populi’s Hot Points: The third chart shows consumers’ top-line for healthcare spending: that healthcare makes up 20.6% of U.S. consumer spending versus spending on other commodities. That’s just over $1 in every $5 for each U.S. health citizen.

Health Populi’s Hot Points: The third chart shows consumers’ top-line for healthcare spending: that healthcare makes up 20.6% of U.S. consumer spending versus spending on other commodities. That’s just over $1 in every $5 for each U.S. health citizen. Doctors have a complicated relationship with electronic health records (EHRs): two-thirds of primary care providers (PCPs) see value in digital records (EHRs), but at the same time believe the technology has weakened relationships with patients, detracted from clinical effectiveness, and lack streamlined user experience. That deficiency is, in three words, lack of interoperability; that challenge has required one-half of physician-users to use work-around’s to make their EHR investments more useful.

Doctors have a complicated relationship with electronic health records (EHRs): two-thirds of primary care providers (PCPs) see value in digital records (EHRs), but at the same time believe the technology has weakened relationships with patients, detracted from clinical effectiveness, and lack streamlined user experience. That deficiency is, in three words, lack of interoperability; that challenge has required one-half of physician-users to use work-around’s to make their EHR investments more useful. The second chart illustrates the gap between doctors’ EHR wants versus EHR abilities. Physicians’ top-ranked importance factor for EHRs is to maintain a high-quality record of patient data in the EHR over time, with virtually 100% agreement among doctors (99%). This importance factor is closely followed by providing an intuitive user experience (97%), sharing information with providers across the care continuum (95%), coordinating care for patients with complex conditions (94%), change or adapt in response to user feedback (91%) and facilitating better patient-provider interaction (91%).

The second chart illustrates the gap between doctors’ EHR wants versus EHR abilities. Physicians’ top-ranked importance factor for EHRs is to maintain a high-quality record of patient data in the EHR over time, with virtually 100% agreement among doctors (99%). This importance factor is closely followed by providing an intuitive user experience (97%), sharing information with providers across the care continuum (95%), coordinating care for patients with complex conditions (94%), change or adapt in response to user feedback (91%) and facilitating better patient-provider interaction (91%). Most physicians want more time to spend with patients. Most physicians rarely have time to address all patients’ questions and concerns, the third chart from the Stanford/Harris survey shows.

Most physicians want more time to spend with patients. Most physicians rarely have time to address all patients’ questions and concerns, the third chart from the Stanford/Harris survey shows. Adopting these new digital tools, when they can positively impact the doctor’s workflow and patient life-flow, will help to improve the EHR experience for both doctors and patients. How quickly these will be adopted into mainstream practice remains to be seen: sooner, better. If not, EHRs are a very expensive data storage option.

Adopting these new digital tools, when they can positively impact the doctor’s workflow and patient life-flow, will help to improve the EHR experience for both doctors and patients. How quickly these will be adopted into mainstream practice remains to be seen: sooner, better. If not, EHRs are a very expensive data storage option.