In the news, we hear a lot about the high cost of pharmaceuticals. Just this week, there are rumors that Donald Trump will give a “major address on drug prices“. HHS Secretary Alex Azar recently stated that “Bold action is on the way’ for drug prices.” At the same time drug rebates are coming under fire as well from the FDA. With all this press, one would expect that life sciences companies are making profits hand over fist.

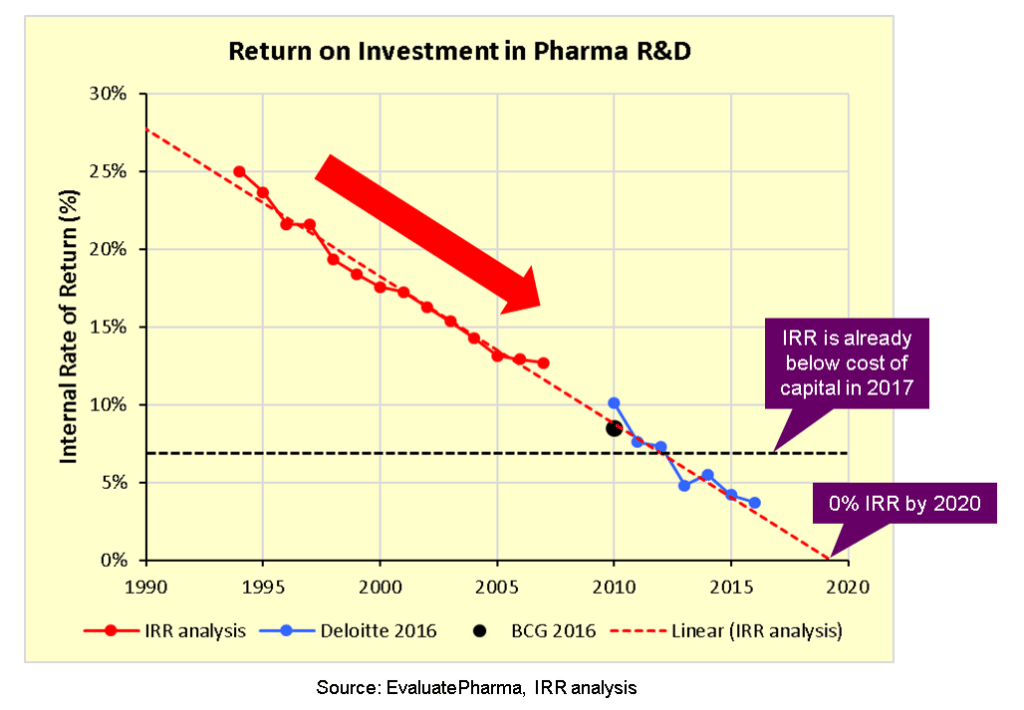

A recent analysis by EvaluatePharma, however, finds that pharma’s internal rate of return (IRR) has below the cost of capital in recent years and could fall to a 0% IRR by the end of the decade.

Why is this? Although successful drugs often are expensive, most drugs fail. Thus, while the returns from a blockbuster drug are large, returns from a companies’ entire portfolio may be very modest. Additionally, finding a new blockbuster drug is hard, due to the Law of Diminishing Returns. If you have a blockbuster treatment, it is very hard to have another blockbuster in the same space. Consider the case of recent Hepatitis C virus (HCV) treatments Sovaldi and Harvoni. These treatments have basically cured HCV so finding an improvement over these treatment will be increasingly difficult. Additionally, more regulation and demands for larger and longer clinical trials drive up R&D cost. Further, payer demands for clinical trial and real world evidence, plus the need to offer large rebates also push down profitability.

In the graph, we do see that IRR is below the cost of capital only for the last 4 years. Thus, this may be a temporary blip rather than a long-term trend. Nevertheless, if we want innovation to continue to occur, we need to make sure innovators are incentivized to invest in the latest and greatest new treatments. Balancing the need for affordability for patients while incentivizing innovation is one of the key challenges facing our health care system today.

Is pharma rolling in cash or on the brink of a long-term decline? posted first on http://dentistfortworth.blogspot.com

No comments:

Post a Comment