The fact that the average U.S. employer committed to spend nearly $27,000 a year for a PPO to cover a family of 4 in America in 2017 is the most important rationale underlying the announcement that Amazon, Berkshire-Hathaway, and JP Morgan made on 30th January 2017.

The fact that the average U.S. employer committed to spend nearly $27,000 a year for a PPO to cover a family of 4 in America in 2017 is the most important rationale underlying the announcement that Amazon, Berkshire-Hathaway, and JP Morgan made on 30th January 2017.

That news immediately shook Wall Street trading, sending downward shocks down the proverbial spines of healthcare insurance plans and suppliers to the industry — legacy healthcare companies that scale patient-members and healthcare supplies, like pills and surgical implants.

That news immediately shook Wall Street trading, sending downward shocks down the proverbial spines of healthcare insurance plans and suppliers to the industry — legacy healthcare companies that scale patient-members and healthcare supplies, like pills and surgical implants.

The “new competition” chart published in the Wall Street Journal in the morning illustrates those shock waves…the word “disruption” comes to mind, although we won’t know how long-lived this kind of statistic will be. The companies illustrated are Express Scripts, the pharmacy benefit manager; CVS, the pharmacy which recently announced intentions to acquire Aetna, the health plan (also hit hard by the A-BH-JPM news), along with United HealthGroup, Cigna, and Anthem, the other major U.S. health insurers.

What has been long-lived, for the better part of two decades, is the upward climb of healthcare costs facing employers, who pay for 50% of healthcare in America. And, increasingly, employee-patients, who have become important payors in the process, as well, shouldering many thousands of dollars of that PPO cost in the form of shared premium, copayments, and coinsurance, according to Milliman, the actuaries, who calculated that $26,944 PPO cost figure.

The A-BH-JPM alliance isn’t about creating a new health plan, I’m sure. If you read this CNBC interview with Gary Cohn who closely works with President Trump, you would see he believes it’s akin to this White House’s push for association health plans as a Holy Grail to reduce healthcare costs. (Hint from this health economist — they won’t do that).

What the promise of the triple threat could bring would leverage the team’s data chops, enchanting consumer-centered design (#UX for you design wonks), trust (which bolsters consumer health engagement), and a collective passion for innovation.

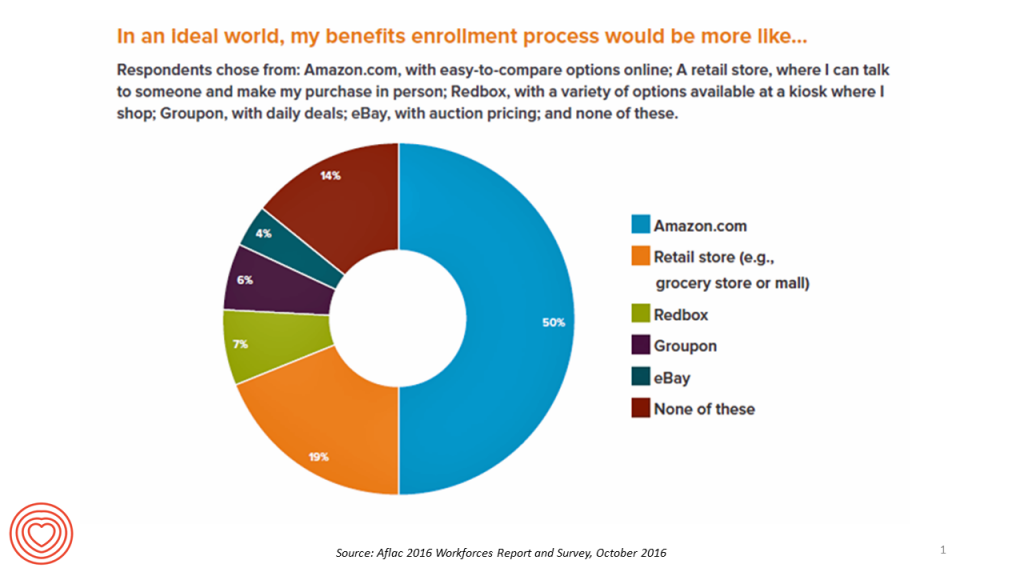

Remember: when Aflac asked health consumers what they’d like their health insurance shopping experience to look like would be, 50% of folks said, “like Amazon.”

Remember: when Aflac asked health consumers what they’d like their health insurance shopping experience to look like would be, 50% of folks said, “like Amazon.”

Health Populi’s Hot Points: I’ve analyzed the Milliman Medical Index for many years here on Health Populi, and use it in my advisory work. For each version, I identify stuff you could spend the PPO money on if not the health plan — usually I pick a car that’s priced at that PPO cost, and a second item such as a year at a university for a college student.

Ironically, last May, I picked 28 shares of Amazon stock, which at the time was worth roughly $27K.

Today, those 28 shares of Amazon stock would be valued at around $40,000. Amazon stock traded up over $8 today. Just think – one and one-half PPO plans…!

I will have more to say, over time, about this venture. For now, know that Warren Buffett has bitten that tapeworm that he’s long complained about, and based on my Twitter feed today, many of us are paying very close attention to the venture.

That includes many stock market investors whose holdings today got bit, hard.

The post Warren Buffett’s Healthcare Cost Tapeworm & His Alliance with Amazon and JPMorgan appeared first on HealthPopuli.com.

Warren Buffett’s Healthcare Cost Tapeworm & His Alliance with Amazon and JPMorgan posted first on http://dentistfortworth.blogspot.com

No comments:

Post a Comment